With the practice of social distancing, everyone is forced to stay home and stop all the social activities. As people get stuck at home, the demand of gaming and esports is at record high. In this article, we will explain how COVID-19 is taking gaming and eSports to the next level, and we have also interviewed Sze Yan Ngai, Chairman of Gameone Holdings Ltd as well as the Hong Kong Game Industry Association (HKGIA), to find out how Hong Kong’s game industry fares amid the COVID‑19 outbreak and his views regarding the post‑pandemic market.

COVID-19 Is taking gaming and eSports to the next level

According to Nielsen Games Video Game Tracking (VGT), 63% of gamers spent more time playing video games since the outbreak of COVID-19, the increase percentages in the 4 highest countries are the U.S. (46%), followed by France (41%), the U.K. (28%) and Germany (23%). As gamers spent more time playing video games, revenues of many gaming companies have increased sharply during the pandemic. Gaming companies like Nintendo reported that its Q1 2020 operating profit grew an incredible 428%, with sales of the company’s social simulator ‘Animal Crossing: New Horizons’ topping out at 10.63 million units for the quarter. Since the game’s launch in March, Nintendo has sold an astonishing 22.4 million copies of the title.’

Same theory also applied to esports industry. During COVID-19, gamer and part of sport enthusiast who cannot enjoy live sports are now switching to esports too. Despite the popular esports like League of Legends and DOTA 2, some global sport associations like NASCAR, the NBA also set up their esports leagues: ‘eNASCAR iRacing Pro Invitational Series’ and ‘the NBA 2K tournament’ to engage with their fans in a virtual environment. Some of these leagues even appear on major US broadcast like Fox and cable television networks.

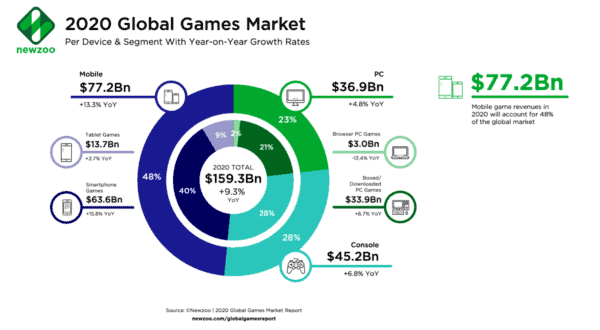

Global and Hong Kong Games Market

The global games market, including PC and mobile gaming, was worth about US$146 billion in 2019, similar to $157 billion market value of the global audio‑visual entertainment industry [1]. According to Newzoo, a company specialising in games and e‑sports analytics and market research, the market value of the global game industry is expected to reach $159 billion this year amid the outbreak, surpassing the global audio‑visual entertainment market for the first time.

During the pandemic, gamers in the Asia‑Pacific region, which accounts for about 50% of the global games market, are particularly active in playing and live streaming. As a result, Asian market leaders such as Nintendo and Tencent all recorded substantial revenue growth in the first half of 2020. Hong Kong has more than 100 game‑development companies, providing mainly Chinese‑language online and mobile games in Hong Kong, Macao, Taiwan and certain Southeast Asian countries. Given the size of the local games market, game‑development companies employing 50‑100 people are few and far between.

Global Competition Heats Up

Investment in game development can be divided into four tiers. Investment in S‑tier games, the highest rank, exceeds HK$10 million. A‑tier games require a minimum investment of HK$8 million and a development team of 20‑30 persons. B‑tier games involve an investment of at least HK$3 million and a team of about a dozen. C‑tier games need HK$500,000‑1,000,000. Game developers in Hong Kong mainly develop A‑C tier mobile games. Their in‑house teams normally spend six months to two years developing the game system, while scenery and character designs, dubbing and music production are outsourced to professionals or freelancers in the relevant fields.

Hong Kong has a free and open games market. Local game developers not only face the challenge of international S‑tier games but also competition from mainland counterparts. Sze explains: “In recent months, many mainland games have chosen to launch in Hong Kong first because the pandemic has slowed down the approval process on the mainland. Our mainland peers simply change the language from simplified Chinese into traditional Chinese, then they can release the game on Google Play or App Store and start online promotion on various social platforms.”

According to Sze, Hong Kong’s game industry is playing a diminishing role in the launch of mainland games in the city. He says in the past, the internet and traditional media both played important roles, with game production and the supporting industry thriving side by side. For a mainland game to enter the Hong Kong market, it had to put its Hong Kong version on a local server and rely on the city’s industry players for referrals to various advertisers and celebrities and the staging of physical promotions. There were as many as 10 local gaming magazines a decade ago, yet the industry today is dominated by international apps download platforms and social platforms, which greatly reduces the work and cost required for games distribution and promotion.

Sze says Hong Kong’s game industry can also take advantage of the convenience provided by international platforms to promote local games overseas, explaining: “Our Chinese‑language mobile games are equally popular among overseas Chinese communities, such as Taiwan, Macao, Malaysia and Singapore. Occasionally, some Chinese‑language games would be translated into English and launched in countries such as the US, Japan and South Korea. Due to cultural differences, however, the English‑speaking markets regard games translated from Chinese as desserts rather than the main dish.” Sze suggests that industry players interested in venturing into international markets should spend more time studying the culture of the target markets and put promotion in the hands of partners who are well acquainted with the local conditions.

Market Opportunities in GBA

In a mainland consumer survey conducted by global management consulting firm McKinsey during the COVID‑19 pandemic, 15% of respondents said they spent more time playing online games while 5% played online games for the first time. The Guangdong‑Hong Kong‑Macao Greater Bay Area (GBA) has seen strong economic growth in recent years. As their living standards continue to improve, the region’s 70 million people can somewhat sustain their spending on “stay‑at‑home entertainment” even amid the pandemic. Following the gradual implementation of the Outline Development Plan for the GBA, government departments in the region are expected to introduce different measures to deepen cross‑border co‑operation and market openings in cultural and creative industries. Known for its East‑meets‑West culture, Hong Kong is well placed to assist in the opening up of the game and creative market in the GBA.

As Macao and the nine GBA cities share the same cultural roots with Hong Kong, the close cultural exchanges in the region are bound to generate a wealth of opportunities for local game‑production companies. As Sze explains: “The GBA has a population 10 times bigger than that of Hong Kong and shares the same language and culture with us. It is a market with huge potential for Hong Kong’s game industry.”

Sze says most Hong Kong companies seeking access for their games to the mainland market would choose to sell their copyright to mainland online game operators. According to the Trade and Industry Department, under the CEPA Agreement on Trade in Services, game companies in Hong Kong may co‑operate with mainland companies in the early stage of development and production of online games, but not their online operation. Hong Kong game companies and mainland‑Hong Kong joint‑venture companies are both classified as “foreign‑invested internet cultural business entities” and, as such, must apply for permission to launch online and mobile games through mainland enterprises holding the licence for online publishing services.

In order to further open up the GBA games market, Sze recommends granting quotas to Hong Kong game companies to directly distribute and operate games in the GBA to begin with. Apart from helping micro, small and medium‑sized Hong Kong firms develop their entertainment businesses in the GBA, this would also attract foreign investment to the city’s game‑creation industry and boost the long‑term development of cultural and entertainment industries in the region.

While continuing to follow the development in the GBA, Sze also encourages young people interested in the creation of online games to better understand gamers’ tastes and demands as well as technological developments and their applications. Explaining that online games are not only for mass entertainment, he says: “They can also act as a medium for interpersonal communications. Even though we cannot meet our friends or relatives in times of social distancing, we can still keep in touch and interact through online games. Game creators must know what gamers need in order to design an irresistible product.

“Moreover, the development of 5G will greatly increase the volume and rate of information transfers and provide more creation and innovation space for the game industry in future. Although the pandemic may slow down the completion and popularisation of 5G infrastructures and disrupt big game developers’ plans on 5G games development, it will also give stakeholders more time to perfect their game designs and promotion strategies. Since 5G is expected to be the main axis for the future growth of the game industry, industry players should pay greater attention to its development in order to have a better grasp of opportunities in this field.”

Visit HKTDC research and read the full version of the article

Check out the latest video game accessory products at hktdc.com Sourcing and talk to our suppliers for more information