From digitisation to disintermediation, the pandemic has significantly accelerated sourcing trends that have been unfolding over the years. Meanwhile, geopolitical shifts, the war in Europe, and conflicts in the Middle East are prompting companies to reassess their sourcing strategies as they strive to build more agile and resilient supply chains.

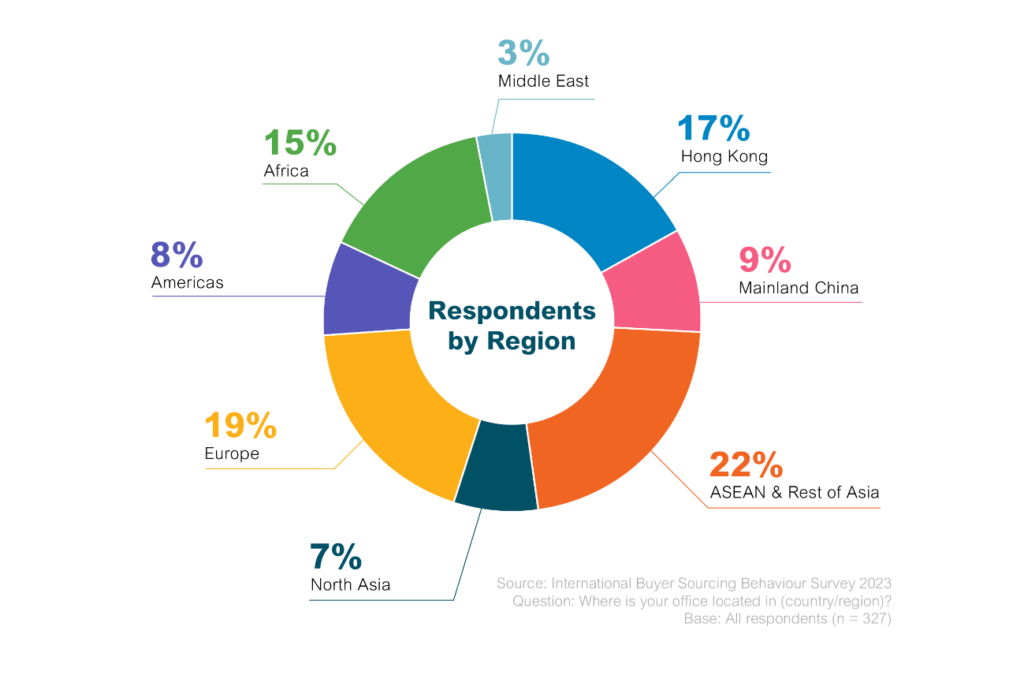

Conducted by HKTDC from October to November 2023, International Buyer Sourcing Behaviour Survey delves into the details of the evolving sourcing ecosystem, offering insights for buyers and suppliers to navigate the fast-changing landscape as they develop and expand their businesses in the coming year.

Emerging Sourcing Priorities

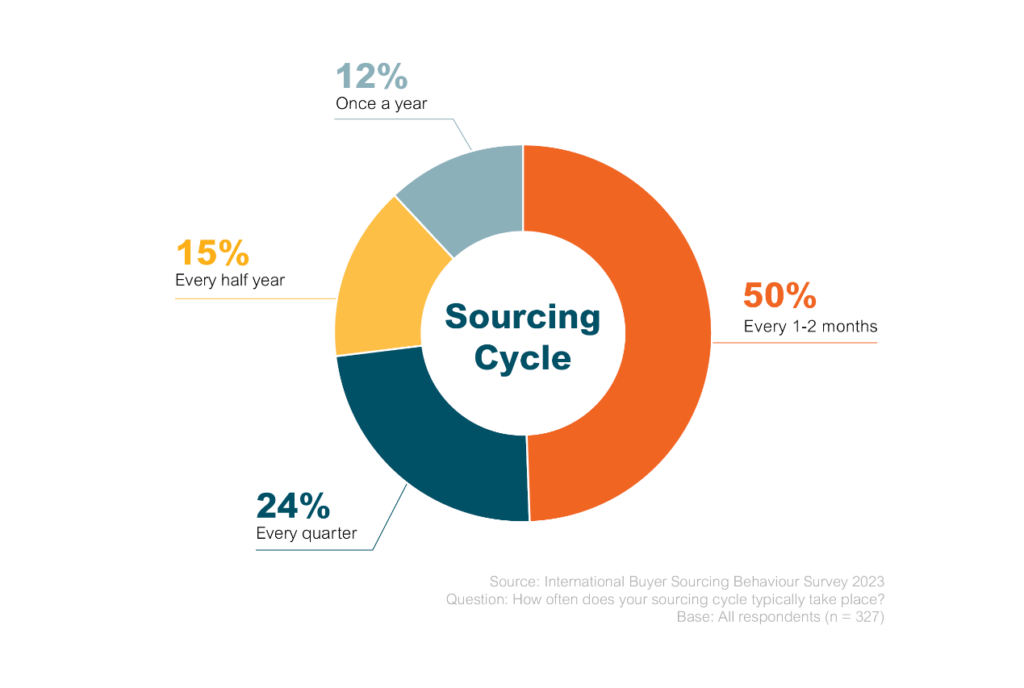

Perspective #1: Shorter sourcing cycles and more frequent orders

Amid the COVID-19 pandemic, the substantial disruptions faced by supply chains forced many buyers to prolong their sourcing cycles, resulting in more cautious order placements[1]. However, a noteworthy shift has since transpired: in 2023, 50% of surveyed buyers sourced products and services every 1-2 months, and an additional 24% opted for quarterly orders. As concerns about pandemic-related disruptions ease, buyers now have the freedom to move away from the “just-in-case” sourcing models that replaced the more efficient “just-in-time” paradigm during the pandemic, to a more balanced approach in order to meet evolving customer expectations[2].

[1] https://research.hktdc.com/en/article/MTI1MTM5MzYxNA

[2] https://www.reuters.com/business/retail-consumer/big-us-retailers-just-in-time-inventory-habit-makes-comeback-2023-08-23/

Perspective #2: Three things suppliers must do to satisfy B2B Buyers’ needs

As supply chains come under pressure, 86% of buyers across all industries indicated that they were looking for suppliers which are reliable first and foremost, before placing orders. The ability to be an effective communicator was cited as another key quality by 53% of buyers eager to foster collaboration and avoid last-minute surprises. Finally, 40% of buyers said that third-party certification was an important consideration, as it reassures buyers about a supplier’s quality while helping them satisfy their compliance requirements. Hence, it appears that reliability, responsiveness, and credibility serve as the pillars of trustworthiness when it comes to selecting supplying partners.

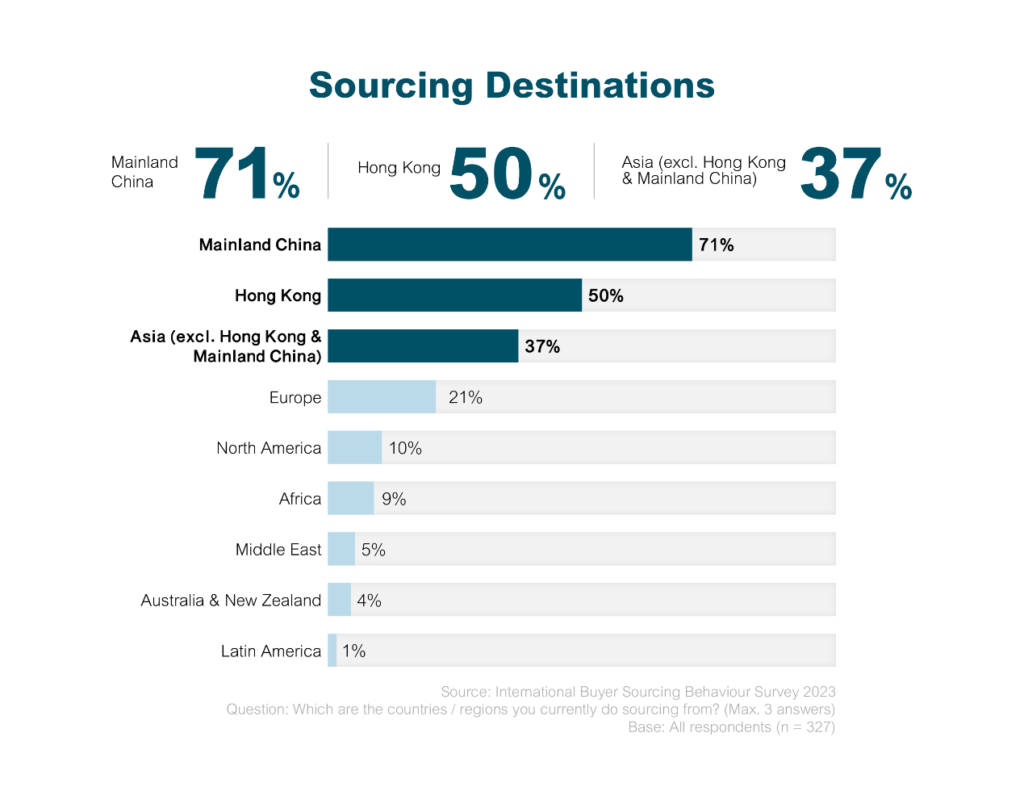

Perspective #3: Most popular sourcing destinations

HKTDC’s findings confirm that Mainland China remained the leading sourcing destination as per 71% of surveyed buyers, followed by Hong Kong (50%) and Asia (37%). According to recent research, China’s appeal is rebounding for EU and American firms and the country is also garnering significant interest from emerging regions such as Latin America. Concurrently, Southeast Asia is proving increasingly popular with European and American companies eager to diversify their supply chains as part of the “China Plus One” strategy[3], due to the region’s proximity to Mainland China, economic neutrality and relative political stability. In addition, while China remains a dominant force, other Asian countries continue to climb the value-chain across many industries[4], a rise attributed to factors including an abundance of natural resources, a low-cost but skilled workforce and the region’s ability to adopt new technology.

[3] https://www.spglobal.com/marketintelligence/en/mi/research-analysis/asean-china-plus-one-destination-current-situation-risk-outlook.html

[4] https://www.bbvaresearch.com/wp-content/uploads/2023/03/EW_Industry-relocation_int-edi.pdf

The Shift Towards Omnichannel Sourcing

Perspective #4: Favourite sourcing channels

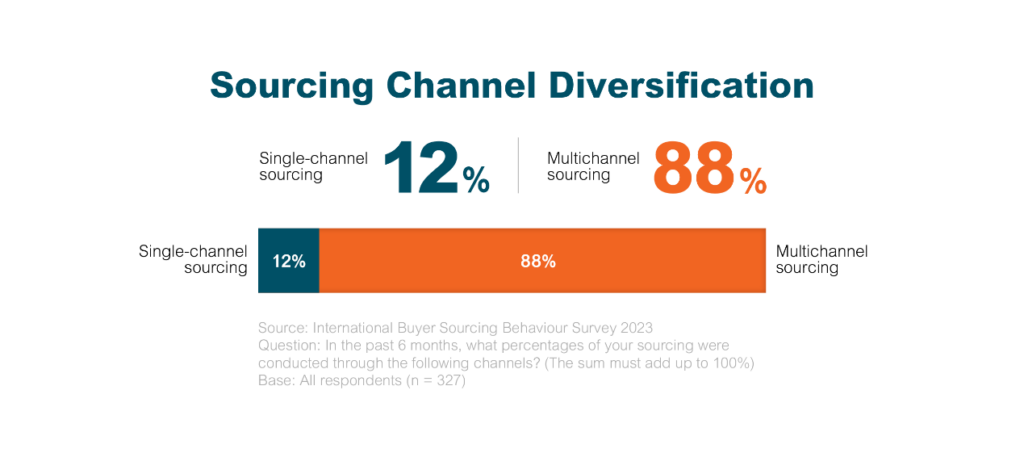

Beyond procuring from existing suppliers and manufacturers, surveyed buyers sourced product and services through physical trade shows (21%), trade partners’ referrals (11%), and online trading platforms/virtual trade shows (10%). Meanwhile 88% of surveyed buyers depended on various channels to fulfil their sourcing requirements. This shift suggests that offline and online channels complement each other instead of competing as buyers utilise different channels to interact with suppliers across various sourcing stages, from supplier search and evaluation to final ordering[5]. In this context, suppliers eager to win orders must formulate compelling omnichannel sales strategies to offer their customers the opportunity to buy what they want, whenever they want[6].

[5] https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/b2b-sales-omnichannel-everywhere-every-time

[6] https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-multiplier-effect-how-b2b-winners-grow

Perspective #5: Hong Kong and Mainland China remain the top physical trade fair destinations

While there is no denying the appeal of omnichannel, in-person trade fairs remain an essential platform for buyers wishing to physically examine and evaluate products, gain new business insights, and develop their professional and social networks with sellers and other buyers. Indeed, since the end of the pandemic, physical fairs returned in full force from the US[7] to Hong Kong[8]. Meanwhile, as per HKTDC findings, Hong Kong (75%) and Mainland China (60%) remain the preferred locations for international buyers participating in physical trade fairs, a preference consistently expressed across numerous surveys conducted over the years.

[7] https://apnews.com/article/ces-2024-tech-show-las-vegas-9bff972274f6820e5edbea0eb1b18f44

[8] https://research.hktdc.com/en/article/MTI1ODk2NTA4OQ

Learn More:

Sourcing Behaviour of International Buyers: Latest Insights and Market Trends

International Buyers See Bright Short to Mid-Term Business Outlook, HKTDC Survey Finds

Perspective #6: Major online sourcing platforms

In the ongoing trend for virtual buying, online sourcing platform Alibaba / AliExpress / 1688.com and hktdc.com Sourcing have taken the lead, with 66% and 62% of respondents having used these platforms in the past 6 months. Additionally, Amazon (31%), GlobalSources.com (26%) and Made-in-China.com (26%) also proved popular with buyers.

Subscribe Today for the Full Report!

Subscribe NewsBites to get the full report of the International Sourcing for 2024 and beyond and stay ahead in today’s rapidly changing market!

You will unlock valuable insights into the following areas:

- Preferred supplier and product factors across industries

- Popular sourcing destinations and target markets

- Key channels utilised by buyers for sourcing and market research

- Trending products that international buyers foresee in 2024

Don’t miss out on the chance to gain a competitive edge by understanding your industry peers’ strategies. Subscribe now for more insights!

Meanwhile, start sourcing on our e-Marketplace today to get a taste of superb experience!

Appendix: Survey Demographics

Related posts:

Tech Fair Survey: How Trade Buyers are Adapting to Changing Market Demands

Tech Fair Survey: How Trade Buyers are Adapting to Changing Market Demands

Sourcing Behaviour of International Buyers: Latest Insights and Market Trends

Sourcing Behaviour of International Buyers: Latest Insights and Market Trends

The Future Is Green: Lifestyle Product Trends and Sourcing Behaviour at HKTDC Lifestyle Fairs

The Future Is Green: Lifestyle Product Trends and Sourcing Behaviour at HKTDC Lifestyle Fairs

International Buyers See Bright Short to Mid-Term Business Outlook, HKTDC Survey Finds

International Buyers See Bright Short to Mid-Term Business Outlook, HKTDC Survey Finds