When you run an e-commerce store selling different product categories, the concept of Contribution Margin comes into play as to company resources allocation to enhance the overall profitability.

In this article, we will introduce the fundamentals of calculating the Contribution Margin and why e-commerce businesses should care about it.

What Is Contribution Margin?

Contribution Margin gauges a product’s production profitability. It reflects the amount of revenue that remains after variable costs, such as raw materials and transportation expenses, are subtracted. It can be expressed as a gross figure or per-unit basis.

This metric illustrates individual product’s impact on the company’s profitability.

The Contribution Margin Formula & Its Components

The primary Contribution Margins formula is as follows:

Contribution Margin = Sales Revenue – Variable Costs |

Alternatively, Contribution Margins can also be determined using fixed costs instead of variable costs with this equation:

Contribution Margin = Fixed Costs + Net Income |

It is useful to understand each component of the above formula:

Sales Revenue

Sales revenue represents the income generated by the company through the sale of its goods or services.

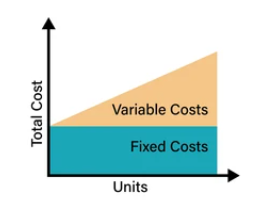

Variable Costs

Variable costs encompass expenditures associated with manufacturing goods or services that fluctuate based on production volume, supplier costs, and labour expenses.

For example:

- Raw materials

- Maintenance costs

- Employee hourly wages and labour expenses linked to production volume

- Sales commissions

- Shipping, freight, and transportation expenses

- Utility costs

Fixed Costs

Fixed costs are expenses that remain constant regardless of changes in production volume.

Examples include:

- Fixed salaries regardless of production fluctuations

- Rent payments and property taxes

- Insurance costs

- Interest expenses

Net Income

Net income is determined by subtracting the cost of goods sold (COGS), operational expenses (e.g., rent, marketing, advertising), interest charges, and taxes from sales revenue. It measures profitability and reveals how much the company’s revenue surpasses its expenses.

Why Contribution Margin Is Significant in E-Commerce?

Contribution Margin is essential to your business for several key reasons:

- Profitability Assessment: It helps you gauge your company’s profitability by revealing how much each sale contributes to covering variable and fixed costs, ultimately generating profit.

- Pricing Strategies: Understanding Contribution Margin allows you to make informed decisions about pricing your products or services. By considering both variable and fixed costs, you can set prices that cover expenses and help you identify areas where cost-cutting measures can be most effective.

- Break-Even Analysis: The break-even point—the level of sales needed to cover all costs. This knowledge helps you set realistic business goals, understand your minimum revenue requirements to avoid losses and make informed decisions about sales strategies.

- Resource Allocation: You can invest more in offerings with higher margins and potentially discontinue or optimise those with lower margins.

- Operational Efficiency: By optimising variable costs and managing fixed costs, you can improve your overall financial performance.

- Product Line Evaluation: Identify which products are the most lucrative and allocate resources accordingly.

Contribution Margin helps you make smart choices about how much to charge for your products, what to sell, and how to sell them. It also lets you check if your money-saving efforts and new pricing ideas work.

Watch out for Part 2 of this article in late July, where we will discuss how companies are using the Contribution Margin to improve business performance!

This article is originally published by Aspire:

Aspire is the all-in-one finance platform for modern businesses, helping over 15,000 companies save time and money with international payments, expense management, payable management, and receivable management solutions — accessible via a single, user-friendly account.

Build a strong e-commerce business with us: