As a business owner, do profit tax calculations make you feel lost or overwhelmed? Specifically, what do we need to pay attention to when doing business in Hong Kong?

Hong Kong’s tax system offers unique advantages for businesses, but success hinges on understanding the rules. This article will cover what profit tax is, how it’s calculated, and the smart deductions that can save you money.

Profits Tax in Hong Kong

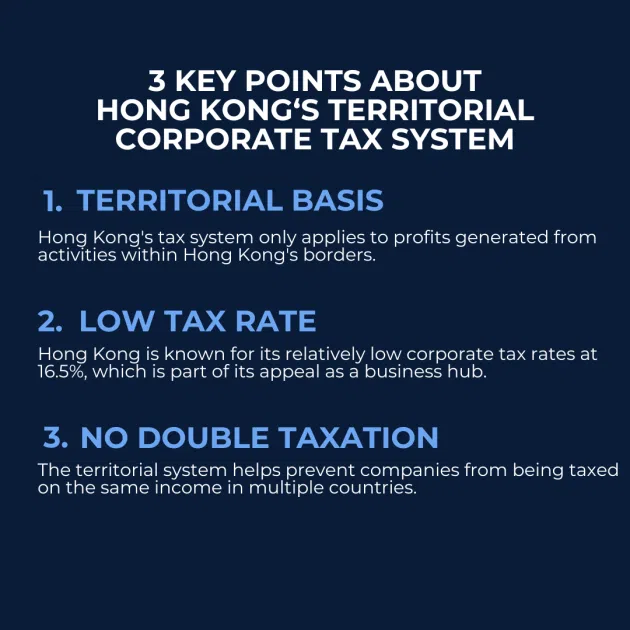

Hong Kong’s profits tax system is a game-changer for businesses. It’s a territorial tax regime, meaning only profits sourced in Hong Kong are taxable. This is great news if your company derives profits from outside Hong Kong – those earnings are exempt from profits tax.

The good news is that even if your profits are sourced in Hong Kong, the tax rates are still incredibly low compared to other jurisdictions. It’s no wonder Hong Kong is a top choice for businesses looking to minimize their tax burden.

Definition

Profits tax is a tax levied on profits arising in or derived from Hong Kong from a trade, profession, or business carried on in Hong Kong.

It is charged on the assessable profits for each assessment year. The tax applies regardless of whether the business is carried on by an individual, partnership, or limited company.

Profits Tax Calculation

Profits tax is calculated based on a business’s net assessable profits, which are arising in or derived from Hong Kong after deducting revenue expenditures and depreciation allowances. The amount is determined with reference to the Inland Revenue Ordinance.

Tax Rates

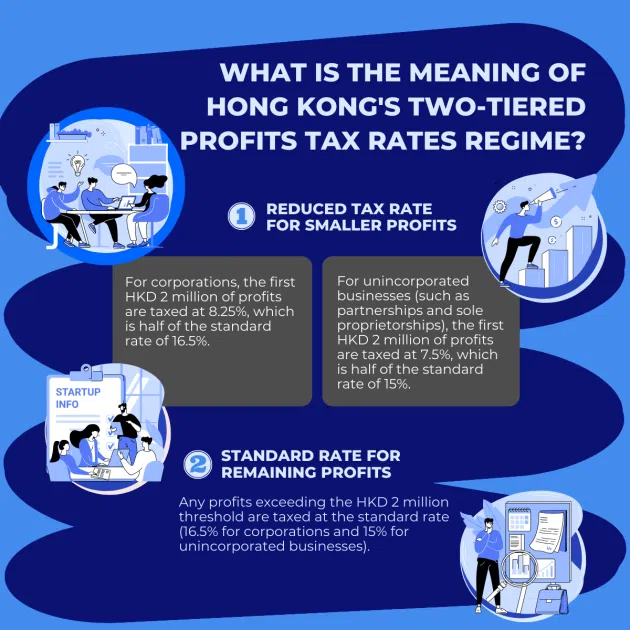

- For corporations, the profits tax rate is 16.5% on assessable profits. However, under Hong Kong’s two-tiered profit tax regime, the first HKD 2 million of profits are taxed at half the standard rate (8.25%).

- For unincorporated businesses like partnerships and sole proprietorships have a standard profits tax rate of 15%. Under the two-tiered regime, their first HKD 2 million profits are taxed at 7.5%.

This two-tiered system has been a lifesaver for many small and medium enterprises. It significantly reduces their tax burden and helps them stay competitive.

Filing Profits Tax Returns

Businesses are required to file profits tax returns annually with the Inland Revenue Department, usually within a month of the return’s issue date. The tax returns must be supported by audited financial statements and tax computations showing how the assessable profits are arrived at.

It is extremely important to file your returns on time and accurately. Late or incorrect filings can result in penalties and even legal action. It’s not worth the risk.

Tax Incentives For Specific Industries

Hong Kong offers various tax incentives to attract businesses and promote certain industries, some of which include:

- Concessionary Tax Rates for Corporate Treasury Centres, Aircraft Leasing, and Ship Leasing activities

- Tax Exemptions for Offshore Funds

- Accelerated Deductions for Research and Development (R&D) expenditures

- Full Write-off of Capital Expenditures on Environmentally Friendly Machinery and Equipment in the first year of purchase

Leverage these tax incentives for better financial health and lower your tax bill!

Key Takeaway

Think about reinvesting those tax savings into business growth or offering more competitive pricing. By understanding the local tax system, taking full advantage of deductions, and proactively seeking professional advice, your business will have a significant financial edge.

Likewise, market your products with a trusted e-Marketplace like hktdc.com Sourcing is of utmost importance to reach out to global buyers in an effective way. Start your sourcing journey with us by hitting below banner:

And let us know if you need a hand on promoting your business!

This article is originally published by Sleek:

Sleek

Sleek is a revolutionary one-stop solution for entrepreneurs, SMEs, and investors. It allows them to register new businesses from anywhere and effortlessly manage their accounting, payroll, tax compliance, business accounts, and governance through a simple online platform with first-class support. With a presence in Singapore, the UK, Australia, and Hong Kong, Sleek has served over 450,000 clients worldwide.