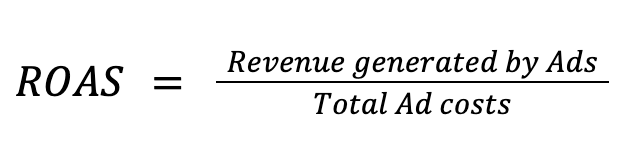

As a business owner or marketer, you probably have heard of ROAS, or Return On Ad Spend. You’ve set aside your budget for advertising. But unfortunately, things can happen that your ad campaign is not performing, due to issues like ads not convincing enough, not reaching your target audiences, or spending too much on the ads.

When launching a brand new product or marketing your company’s services, your return on ad spend (ROAS) becomes your advertising compass. It helps you make every ad penny count, ensuring your budget is effectively allocated.

ROAS helps assess campaign effectiveness and profitability:

For instance, using the ROAS formula, if you invested $2,000 in ads and generated $8,000 in revenue, your result would be 400% or 4:1.

What Is a Good ROAS?

In general, the higher the ROAS, the better.

Reaching a ROAS of 1:1 means you’re breaking even, neither making a profit nor losing money with your ads. You’re basically just covering the cost of advertising with the revenue you’re earning.

On the other hand, when your ROAS is above 1:1, your advertising makes you more money than you spent. The higher the ROAS, the better your ads are at making a profit.

Lots of businesses try to get a ROAS between 3:1 and 5:1. While there’s no “right” answer, a common ROAS benchmark is a 4:1 ratio.

It is essential to recognise that the perfect ROAS can differ significantly based on your industry, business objectives, and profit margins. It can also help to benchmark your ROAS to past campaigns that have performed well.

ROAS vs ROI vs CPA: Which to Use for Marketing?

Each of these marketing metrics tells you something different:

ROAS | ROI (Return on Investment) | CPA (Cost Per Acquisition) | |

Uses | ROAS means to calculate how much revenue your ads bring in for every dollar spent. | It considers the complete investment picture, including operational, production, and other expenses, not solely focusing on advertising expenditures. | It calculates how much it costs to acquire a single customer or lead. |

Pros | Helps you decide where to spend your advertising money better by showing which campaigns make you money. It gives a clear picture of how each campaign is doing. | It gives you a big picture of whether your marketing efforts are making money when considering all the costs. It’s good for seeing the overall impact on your profits. | Focuses on how efficiently you get new customers. It helps to check the different cost-effective ways of getting customers. |

Cons | Unlike ROI, which includes all expenses, it doesn’t consider things like regular business costs. It only looks at how well your advertising money is used. | ROI is not as detailed as ROAS, so it might not tell you exactly which campaigns are doing well. | Doesn’t directly show how much money you make or if you’re profitable. It also doesn’t consider how much money customers may bring in over time. |

Businesses often use a mix of these metrics to get a complete picture of how their marketing is doing.

Watch out for Part 2 of this article in late March, where we will talk more on improving ROAS and its specific uses!

This article is originally published by Aspire: