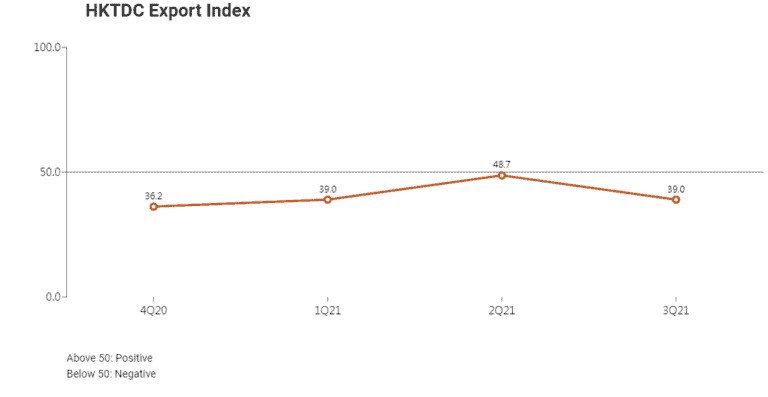

Hong Kong Trade Development Council (HKTDC) announced its Export Index for the third quarter of this year (Q3) fell 9.7 points back to its first-quarter level of 39.0, after rising for five consecutive quarters, as sector and market sub-indexes declined across the board. The latest survey results indicate perceived uncertainties over Hong Kong’s export performance in the coming months, especially during the traditional peak Christmas season.

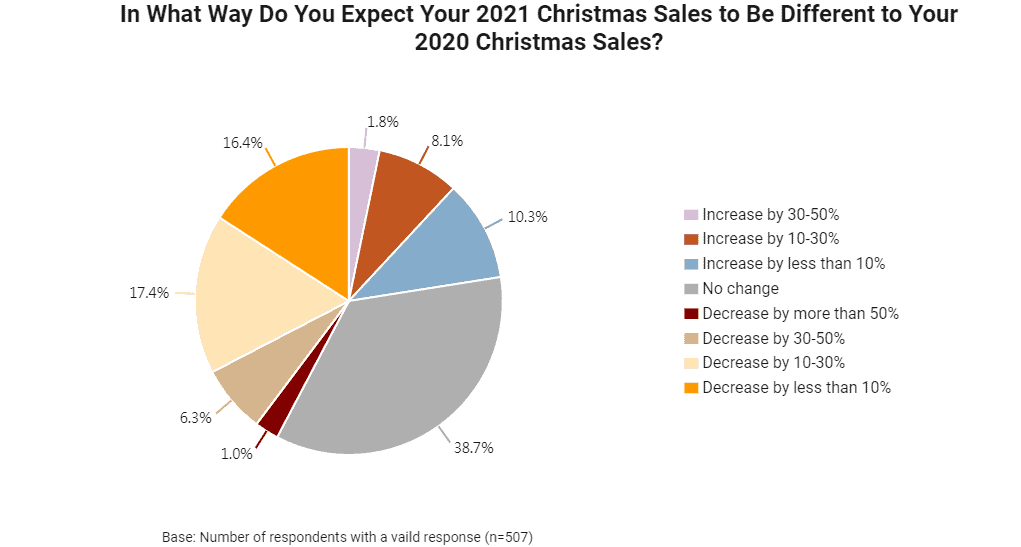

HKTDC Director of Research Nicholas Kwan said business confidence in Hong Kong’s exports for the near term has been undermined by continuing uncertainties over the COVID-19 pandemic and surging transportation costs. Only 20.2% of Hong Kong businesses polled in the Q3 survey anticipated an increase in their Christmas sales this year, compared with 38.7% who foresaw no change and 41.1% who predicted a decline. Most respondents in the latter category expected declines of no more than 30%.

“The key issues seen as affecting Hong Kong’s export performance in the coming six months continued to be the pandemic [45.5%, up 4 percentage points on the second quarter (Q2)] and softening global demand [20.3%, up 3.6 percentage points]”.

Digital transformation accelerates

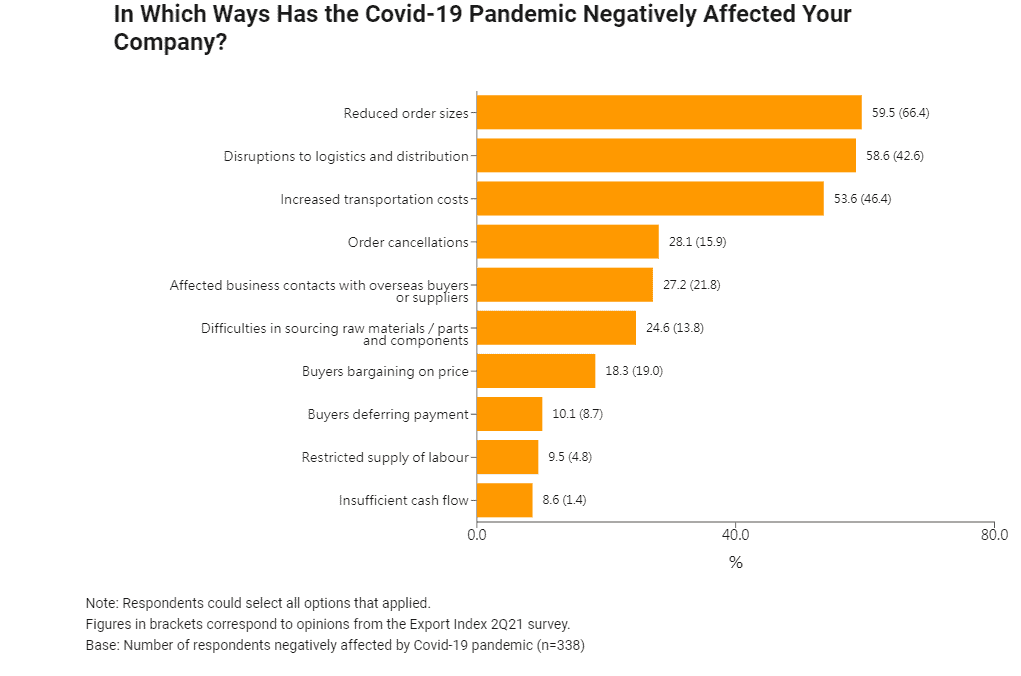

In the survey, the proportion of Hong Kong exporters who reported having been affected by the pandemic (66.6%) rose 9.7 percentage points from Q2. The most-cited pandemic-induced problems include reduced order sizes (59.5%) and order cancellations (28.1%), as well as disruptions to logistics and distribution (58.6%) and increased transportation costs (53.6%). “It is worth noting that an increased proportion of Hong Kong companies reported difficulties in sourcing raw materials, parts, and components. This category accounted for 24.6% of respondents, up 10.8 percentage points from the last quarter. This suggests that the supply chain may have been affected,” Mr Kwan said.

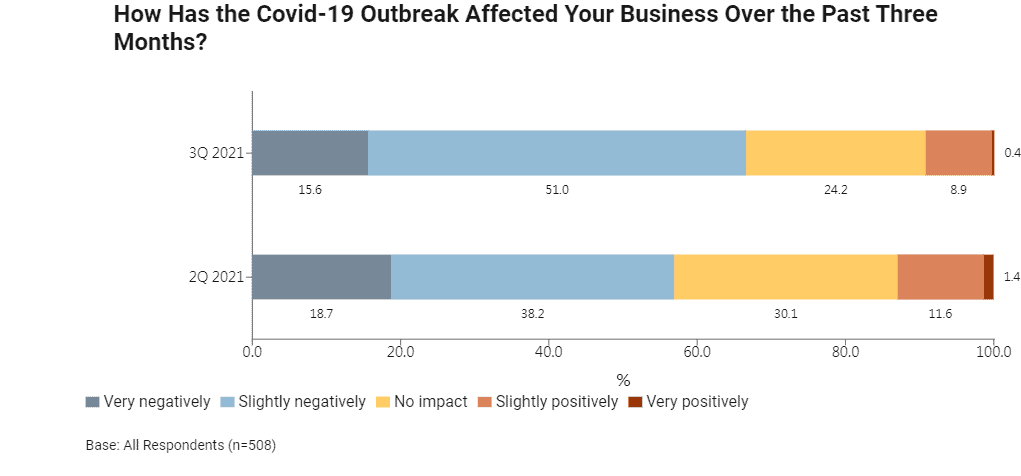

Nevertheless, some Hong Kong firms (9.3%) said the pandemic had positively affected their business, which had benefited from increased product demand, especially in the electronics and toys industries. This is partly attributable to the COVID-19-inspired acceleration of digital transformation among enterprises, a restructuring of the global supply chain, and a shift towards e-commerce, which together saw businesses invest heavily in electronics products to upgrade their operational resources.

“Under the pandemic, quite a number of Hong Kong companies have accelerated their digital transformation,” said Mr Kwan. “The survey found that their digital business strategies include developing an online sales operation [56.3%], promoting products via a digital channel [56.0%], enhancing their cybersecurity [50.2%], developing a cloud computing/online management system [47.7%] and adopting digital payment solutions [31.9%].”

To address current market challenges, many Hong Kong firms said they were considering or would consider adopting various business strategies, including developing Mainland China sales (47.9%), building online sales channels (45.8%), and expanding their product portfolios (44.9%). Meanwhile, an increased proportion of Hong Kong enterprises were planning to diversify into new overseas markets (35.5%, up 7.1 percentage points), mainly in Europe (29.5%) and the Association of Southeast Asian Nations (ASEAN) region (20.5%).

Relatively stronger performers: toys and Japan

The HKTDC conducts the Export Index survey every quarter, interviewing 500 local exporters from six major industries including machinery, electronics, jewellery, watches and clocks, toys, and clothing, to gauge business confidence in near-term export prospects. The index indicates an optimistic or pessimistic outlook, with 50 as the dividing line.

Period | HKTDC | Electronics | Clothing | Toys | Jewellery | Timepieces | Machinery |

3Q21 | 39.0 | 38.9 | 36.1 | 44.0 | 39.9 | 38.2 | 43.8 |

2Q21 | 48.7 | 48.8 | 43.3 | 45.1 | 40.7 | 44.6 | 55.9 |

1Q21 | 39.0 | 39.0 | 36.1 | 44.7 | 42.2 | 36.5 | 42.9 |

4Q20 | 36.2 | 36.4 | 32.9 | 35.9 | 33.0 | 33.5 | 39.5 |

|

HKTDC Export Index by Market |

US |

EU |

Japan |

Mainland China |

ASEAN |

|

3Q21 |

44.3 |

44.1 |

47.9 |

47.8 |

44.5 |

|

2Q21 |

49.0 |

49.2 |

49.8 |

50.3 |

49.1 |

|

1Q21 |

46.1 |

42.9 |

47.3 |

48.0 |

45.2 |

|

4Q20 |

44.4 |

44.0 |

47.3 |

48.4 |

47.2 |

“Among industry sectors, toys recorded the highest reading and a relatively mild drop [44.0, down 1.1 points], while Hong Kong exporters were the least optimistic about clothing [36.1, down 7.2 points],” HKTDC Economist Samantha Yim said. “As for markets, exporters showed the most confidence in Japan [47.9] and Mainland China [47.8].”

The survey also registered declines in the Trade Value Index (54.1, down 2.9 points) and the Procurement Index (36.2, down 9.3 points). The Employment Index, on the other hand, rose by 3.1 points to 44.7, showing the labour market was relatively stable.

Check out our latest products at hktdc.com Sourcing