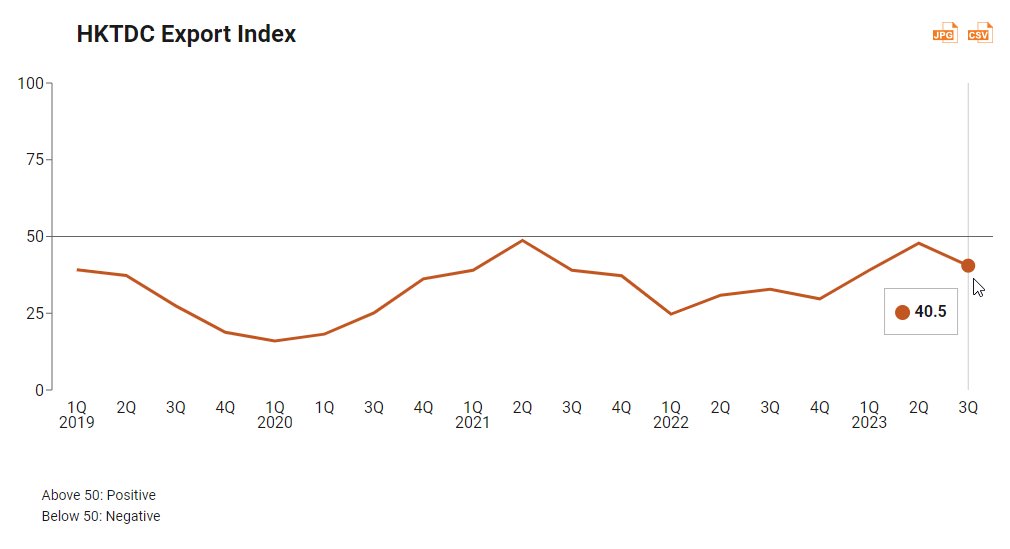

Hong Kong’s export sentiment, one indicator of the city’s economic recovery, softens after the second quarter of the year, as reflected from the HKTDC Export Index 3Q23 survey conducted by HKTDC Research. This business confidence survey, designed to gauge the prospects of the near-term export performance of Hong Kong traders, recorded a two-year high export index last quarter.

Learn More:

Export Index Fell Slightly

After a surge to a two-year high of 47.8 in the previous quarter, the HKTDC Export Index fell to 40.5 in the third quarter of 2023 (3Q23). In fact, the index reading has been fluctuating in the past few years below 50, implying a relatively pessimistic outlook.

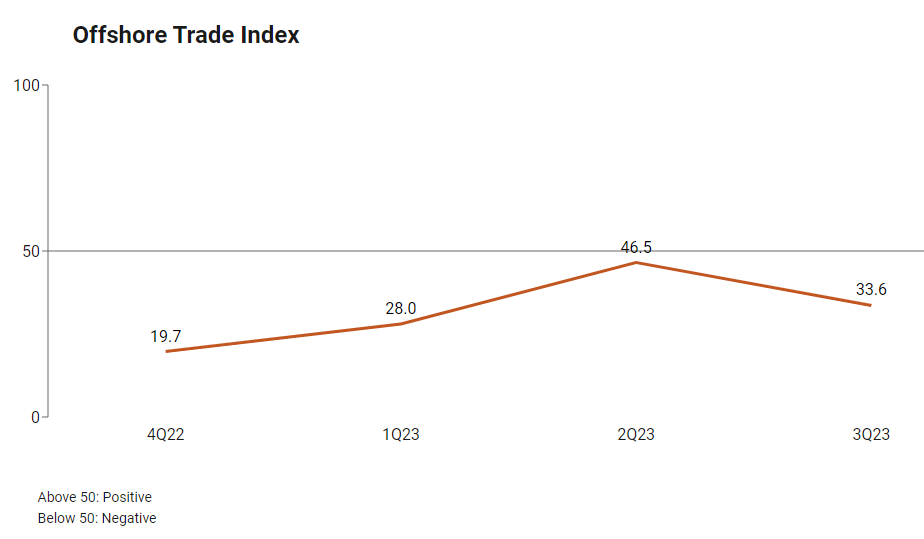

The Offshore Trade Index, which tracks sentiment related to shipments not passing through Hong Kong but managed by businesses within the city, also recorded a decline to 33.6 in 3Q23 amid the sluggish global market.

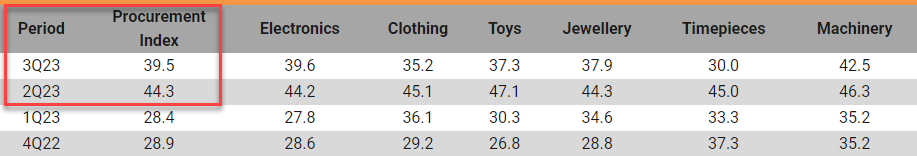

Procurement Activity Remained Subdued

Purchasing activity was down across all sectors including electronics, toys and jewellery, despite lower‑than‑normal inventory levels:

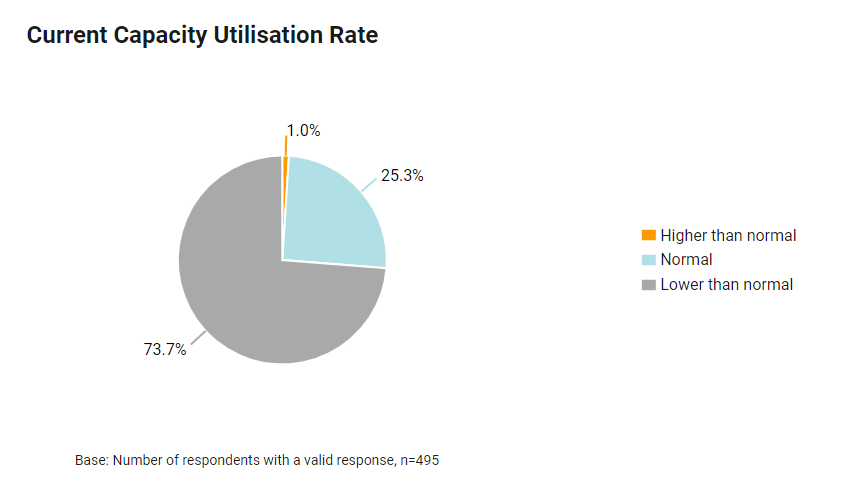

This may be attributable to the fact that more than 70% of the survey respondents are currently operating at less than normal capacity in terms of employment and production equipment utilisation:

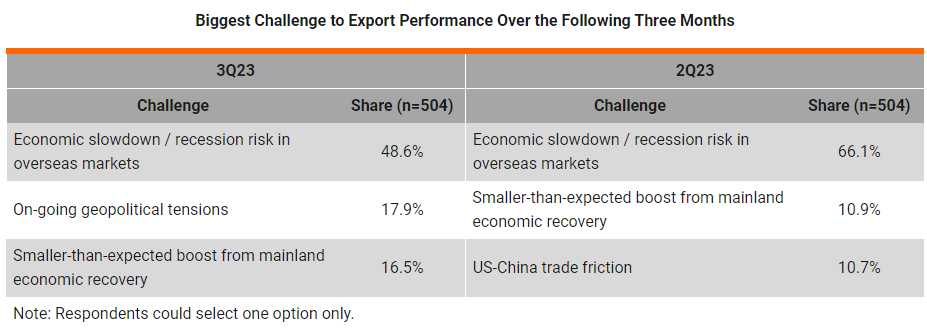

Challenges & Concerns Behind the Fall

Economic risks remain the top concern. Almost half of respondents (48.6%) cited economic slowdowns or recession risks in overseas markets as the biggest challenge, followed by rising geopolitical tensions (17.9%) and a lower-than-expected boost from the Mainland’s economic recovery (16.5%).

Exporters' Strategies Despite the Confidence Drop

Looking towards the year end, exporters’ views on the profitability outlook for their operations were similar to the findings for 2Q23. The majority of respondents (61.7%) expected to see a stable or higher profit margin.

Exporters tend to adopt pro-growth business strategies. The Top 5 are:

- Increasing their marketing, promotional and business matching activities

- Providing a wider range of value-added services

- Cash-flow management

- Diversifying sales to additional overseas markets; and

- Increasing usage of e-commerce

For a deep-dive and a more detailed coverage of the above findings, please read through:

HKTDC Export Index 3Q23: Export Sentiment Softens from Two-year High

Amid challenges in the macro environment, you can still take advantage of our e-Marketplace by extending your reach to global traders beyond physical borders. Act now to secure new business by clicking below banners: