With the Chinese Mainland’s huge e-commerce retail market and supportive governmental policies, e-commerce businesses are gaining numerous market development opportunities in recent years.

To further understand Chinese Mainland consumers’ online consumption habits and their preferences regarding Hong Kong products, HKTDC Research commissioned a market survey agency to conduct a questionnaire survey of 2,200 middle-income class or above consumers from different Mainland cities in 2024. Read this article for a summary of key survey findings, and set your business apart earlier.

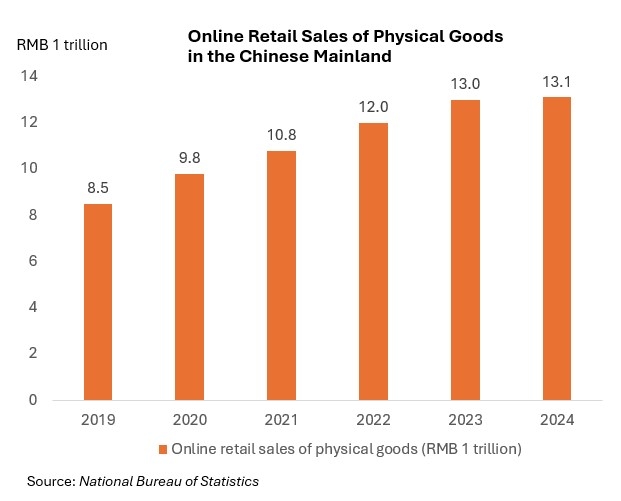

Sustained Growth of Chinese Mainland's Online Retail Sales

Chinese Mainland’s National Bureau of Statistics figures show that the Mainland’s online retail sales of physical goods surged by approximately 54.1% from RMB8.5 trillion in 2019 to RMB13.1 trillion in 2024, signifying a remarkable growth.

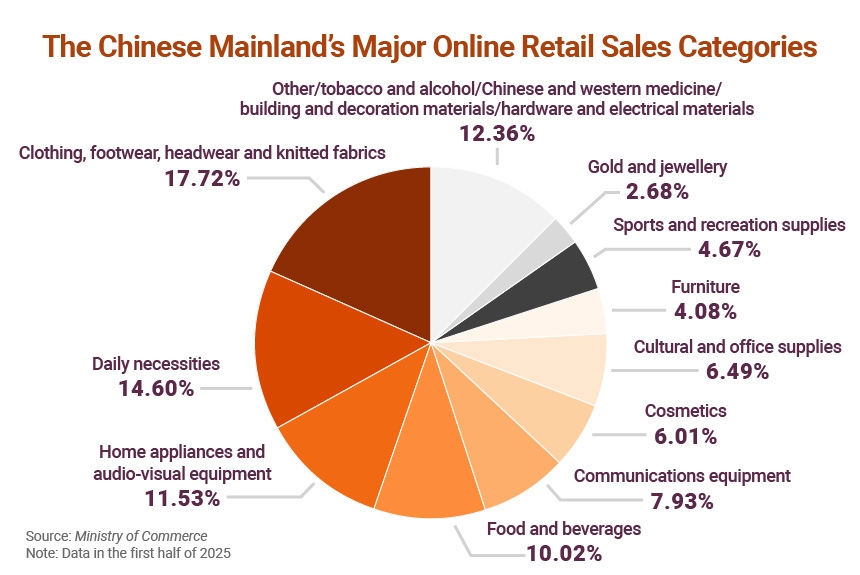

The booming of the Mainland online retail market is reflected not only in the steady growth in total sales but also in the diversification of product categories. Data from the Ministry of Commerce reveal that, in the first half of 2025, consumers were already very accustomed to buying various consumer goods through online channels. In the online retail sales of physical goods, sports and recreation supplies (4.67%) accounted for a sizeable market share.

Characteristics of Online Sports Product Purchases

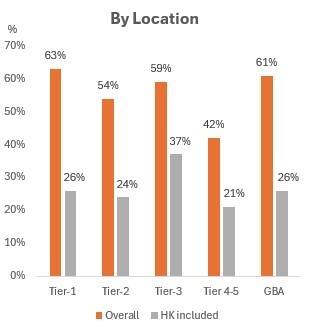

Highest proportion of sports product purchases in tier-one cities

Regionally, consumers in tier‑one cities have the highest proportion of online sports product purchases (63%), followed by Mainland GBA cities (61%).

Hong Kong sports brands becoming popular in tier-three cities

In terms of the market share of Hong Kong sports products, the proportions vary across regions, with the proportion of tier‑three city consumers purchasing Hong Kong sports products online being the highest (37%).

Comprehensive E-Commerce Platforms as Main Online Shopping Channel

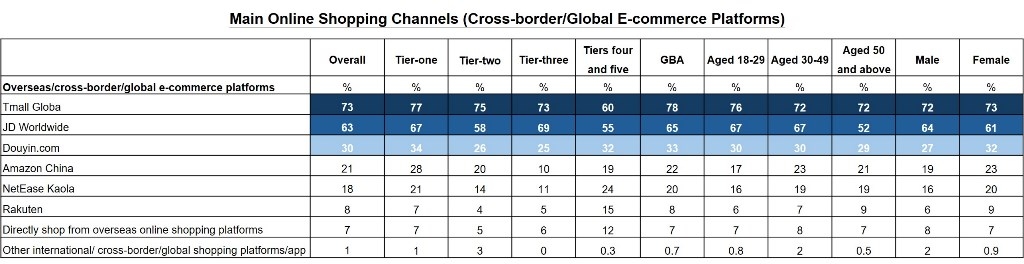

When shopping for overseas/cross‑border/global products, Chinese Mainland consumers generally prefer using Tmall Global (73%) or JD Worldwide (63%). Classified by region, preferences for different platforms are also quite consistent, with consumers in all locations mainly choosing Tmall Global. In terms of age and gender, consumers’ preferences coincide.

Take Advantage of the Sports Product Boom

Looking into the detailed survey findings above, it is obvious that sports product e-commerce is gaining traction across the Chinese Mainland cities, and Hong Kong sports brands performed particularly well in tier-three Mainland cities. This presents enormous growth potential for these sports brands to expand their online retail sales to the tier-one Mainland cities, and the rest of Chinese Mainland.

Since Chinese Mainland consumers prefer large trusted e-commerce platforms to conduct purchase, Hong Kong sports brands should tap into the market with a reputable e-commerce platform to make sure they are having enough online exposure across the competitive digital space.

Explore Full Research Findings

Access detailed insights, including respondent demographics, via:

Chinese Mainland Retail Market: Market Positioning of Hong Kong Sports Products

For B2B trade of sports products, do not miss out on our e-Marketplace where quality meets verified network of global buyers and suppliers.

Explore our collection of sports utilities now:

Sports Supplies FAQ

1. What categories are included under sports products?

Sports products typically cover:

- Apparel – activewear, compression wear, performance clothing.

- Footwear – running shoes, training shoes, hiking boots.

- Equipment – balls, rackets, weights, yoga mats, etc.

- Accessories – sports watches, water bottles, gym bags, protective gear.

- Smart Sports Tech – fitness trackers, smart shoes, connected equipment.

2. What are the main buyer segments in Chinese Mainland’s sports market?

- Urban Millennials & Gen Z: Fitness-conscious and trend-driven consumers.

- Outdoor Enthusiasts: Growing interest in hiking, cycling, and camping gear.

- Team Sports Participants: Basketball, football, and badminton remain strong.

- Wellness & Lifestyle Consumers: Home fitness and yoga driving demand for light equipment and wearables.

3. What’s the outlook for the sports products market?

- Steady Growth: Chinese Mainland remains a major growth hub for sports and fitness goods.

- Innovation Focus: Tech-embedded and sustainable products will lead demand.

- Health & Lifestyle Shift: Post-pandemic awareness continues to fuel fitness-oriented consumption.